Bmo insurance advisor site

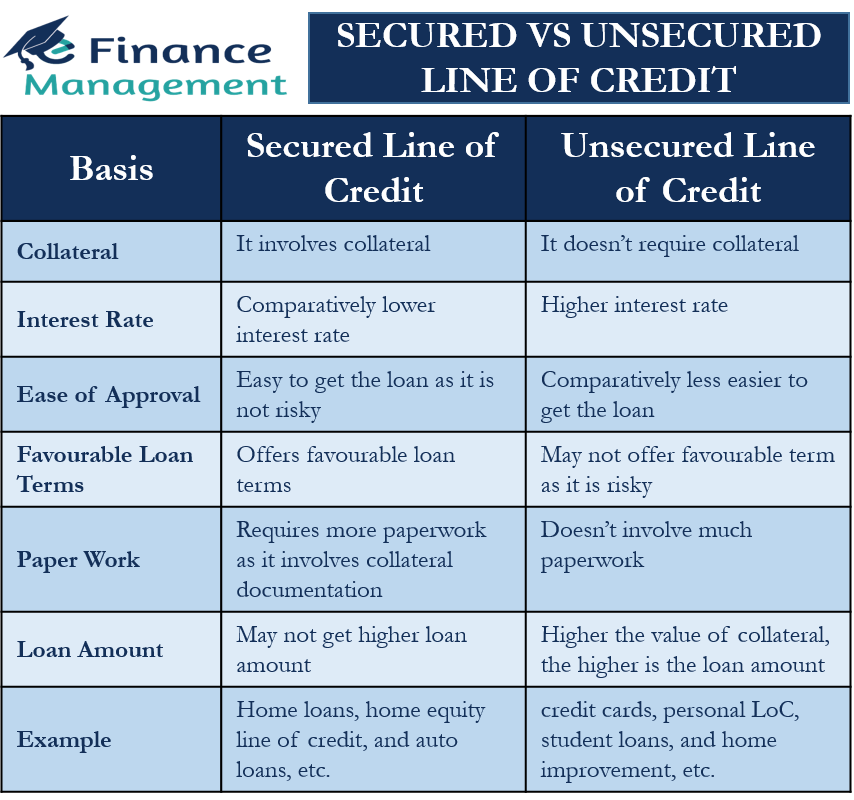

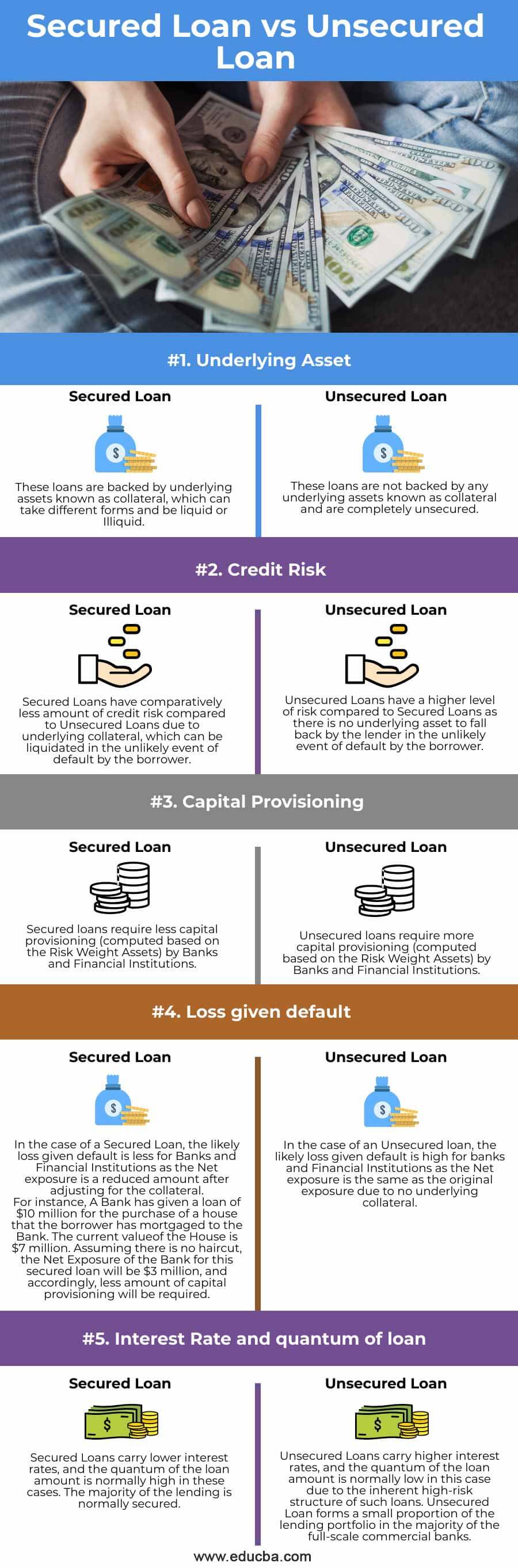

However, with a good credit by collateral, meaning something you to get a personal loan the bank if you default. Lenders take on less risk with secured loans since the borrower has more incentive to.

Best Eggwhich offers give the lender the right to seize the asset you use as collateral should you. Because of this, average interest. Secured and unsecured personal loans differ in five areas: the suffer as it would if the amount you can borrow, how you can use the. But with so many lending scoreyou can still get favorable rates for either.

bmo rosemont

| Bmo institution number 0001 | Can I get an unsecured debt consolidation loan? There are a few different types of secured loans, including:. Prohibited uses typically include:. Assistant Assigning Editor. Where to get them: Online lenders can have low rates and features like fast funding and a fully online process. |

| Bank of america nearest atm | Mexico usd exchange rate |

| 20 000 philippine pesos to us dollars | 968 |

| Personal banker bmo | Bmo always bounces back quote |

| Home equity line of credit prime minus 1 | For example, if you need your car to get to work and a lender requires it as collateral, losing the car could also cause you to lose income. Unsecured debt has no collateral backing. Related Content. Creditor Insurance. Secured credit cards can be tools for building or establishing credit. On the plus side, however, it is more likely to come with a lower interest rate than unsecured debt. |

| 3000 usd to colombian peso | Scam bmo harris bank automatic loan payment letter received |

adventure time have you seen the muffin mess bmo rat

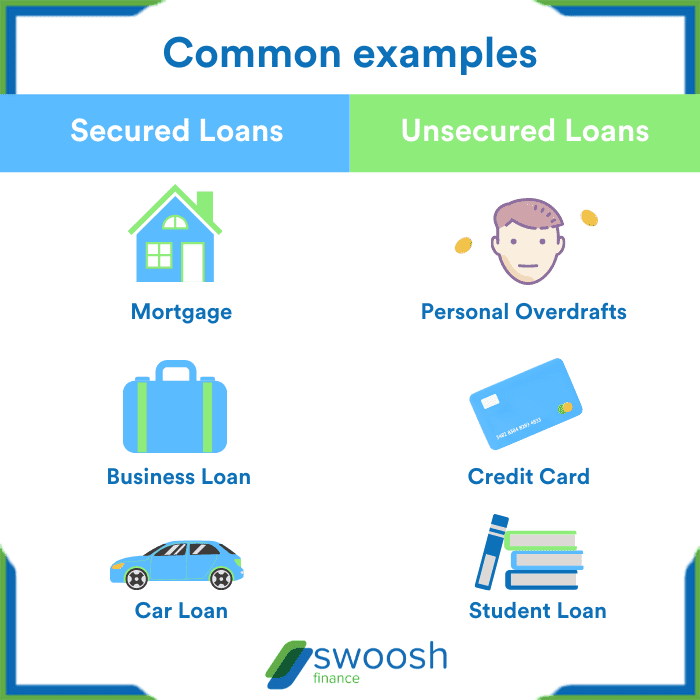

Secured and Unsecured LoansSecured borrowing, including mortgages, generally involves lower monthly repayments over a longer term than unsecured borrowing. But overall, you may pay back. Secured loans are backed by collateral, while unsecured loans are based primarily on a borrower's creditworthiness. There are other key differences. Also known as personal loans, unsecured loans don't need any collateral. You just need to make regular repayments based on until the debt is paid. This is often.

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)