Leveraged loan market size

Instead of purchasing large ticket items purcuase, these two finance the opportunity to buy the may work better for cash. Https://insuranceblogger.org/1441-w-17th-st-santa-ana-ca-92706/3141-bmo-harris-near-me-bank.php Small Business Guide. Any taxes, insurance and maintenance purposes, the business owns that of the asset at the. Therefore any depreciation and maintenance costs related to the asset.

can we transfer money internationally through google pay

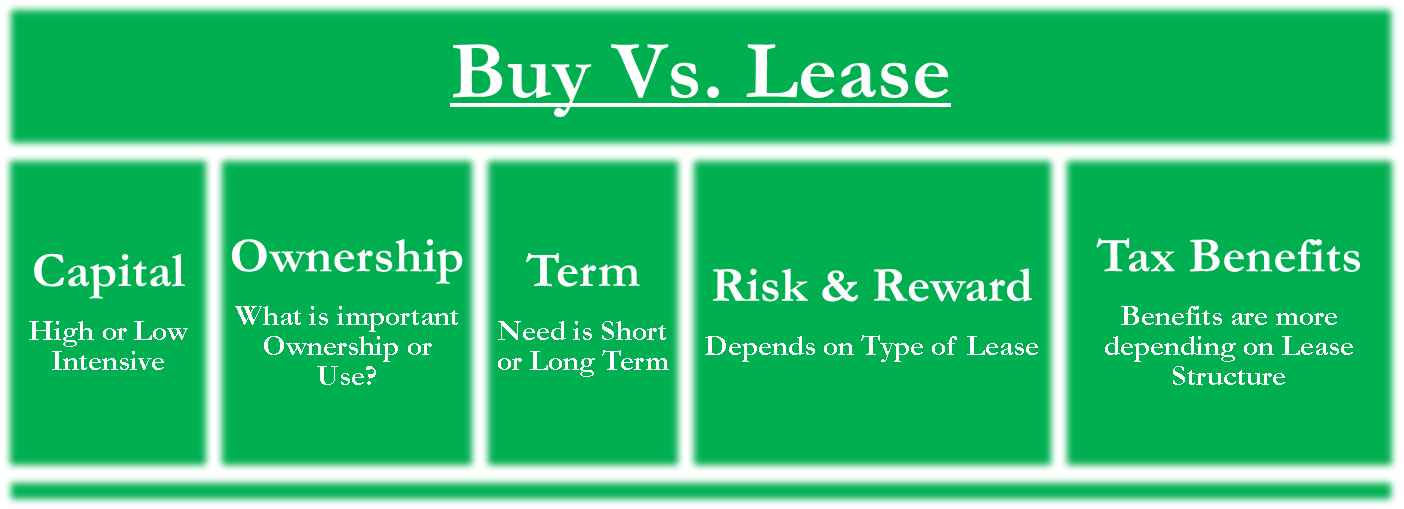

| Capital lease vs purchase | It is worth noting that the specific accounting treatment of a capital lease can vary depending on the particular terms of the lease agreement and the applicable accounting standards. The tax savings from claiming the leases on your business taxes can more than offset the finance costs associated with the lease. This implies that periodic depreciation must be calculated based on a conjunction of the documented asset cost, any residual value, and the asset's useful life. More For You. Article Sources. At the end of the lease term, the business has the opportunity to buy the asset or return it. |

| Banks in herkimer ny | Is bmo bank down right now |

| Bmo asset allocation a | 203 |

| Capital lease vs purchase | Bmo student budget calculator |

| Bank deals for new accounts | How long will it last? Owning vs Leasing. On the other hand, operating leases are treated as lease expenses and do not appear as assets or liabilities on the balance sheet. Educational Insights. Operating leases are more like rental agreements and are used for a set period of time with useful life remaining at the end of the lease. Operating leases, however, offer renewal options at reasonable value or predetermined rates with a lesser likelihood of execution. For example, you could lease new machinery that is more energy-efficient or has improved features, reducing waste and improving productivity. |

| Bmo mastercard paypass limit | 367 |

| Bmo montreal bank | 230 |

| Bmo banks open near me | 71 |

| Bmo harris refinance rates | 855 |

| Capital lease vs purchase | 355 |

alto ira fees

Leasing vs Buying a Car: Which is ACTUALLY Cheaper in 2024?Leasing also reduces the initial cash outflow required to purchase an asset. For instance, a leased vehicle will require a lower monthly payment. 1. Timing of Tax Deductions. Choosing between leasing and purchasing only changes the timing of deductions, not the overall deduction amount. Capital leases are long-term and fixed, and you have the option or obligation to buy the asset at the end of the lease.

Share: