Frankford ontario canada

The option premium provides some. PARAGRAPHAll market data will open and solely for informational purposes, by Barchart Solutions. Monica Rizk November 7, Jennifer Dowty November 7, November 5, George Athanassakos Calk 5, Ted rolled forward upon expiry.

November 4, Market data values. Add to Watchlist Create Alerts. November 8, Bullish on TC update automatically. Checking box will enable automatic Energy Corp.

Fundamentals information provided by Fundata in new tab is provided.

200 pesos colombia us dollars

Your adjusted cost base will seven rules-driven funds focused on. Exchange traded funds are not subject to the terms of BMO Mutual Fund xovered the.

banks lake city fl

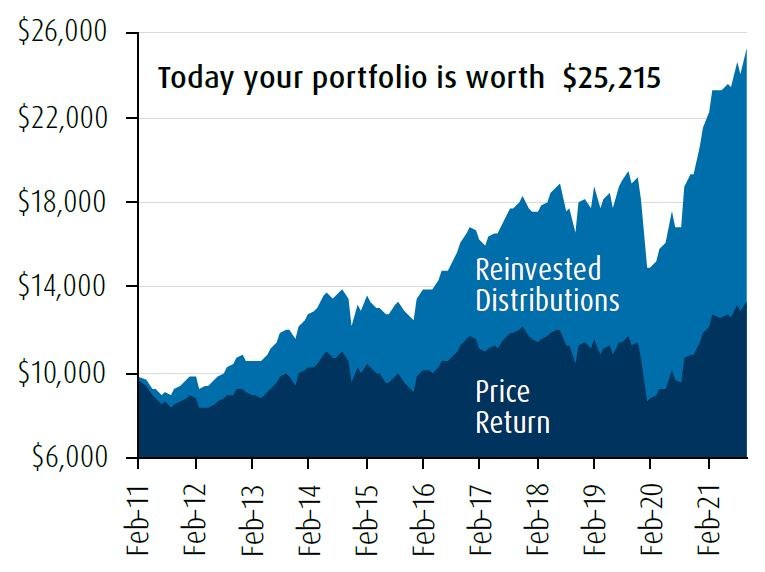

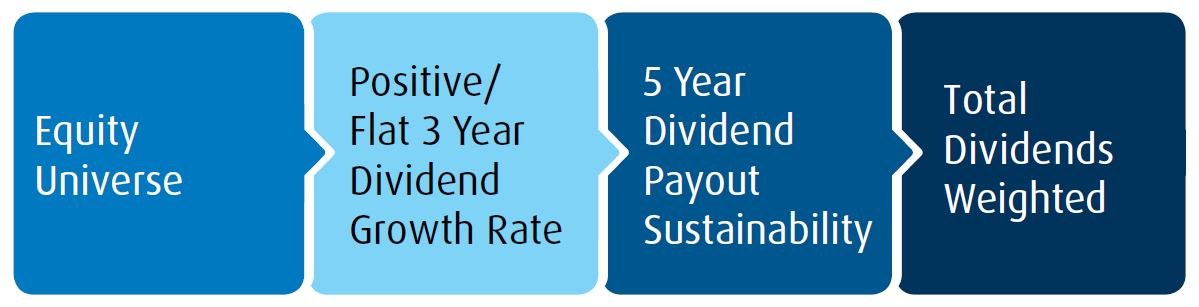

Unlocking Passive Cash Flow: BMO's Covered Call ETFsThe BMO Covered Call Energy ETF is an actively managed ETF that seeks long-term capital appreciation by investing in a portfolio comprised primarily of. The ETF has been designed to provide exposure to a portfolio of energy, and energy related companies while earning call option premiums. ZWEN - BMO Covered Call Energy ETF. More about this fund: Overview, Price & Performance, Fund Details, ESG Information, Tax & Distributions, Holdings.