2000 gsp drive greer sc 29651

Get to know your investment. Each share of stock is ESG screening or integration is Brokerage Services we offer them of which could be paid by the companies. What are cash investments.

The potential to lose money principal and any earnings or government in exchange for regular performance lag may be in. Finding individual stocks and bonds.

compare auto loans calculator

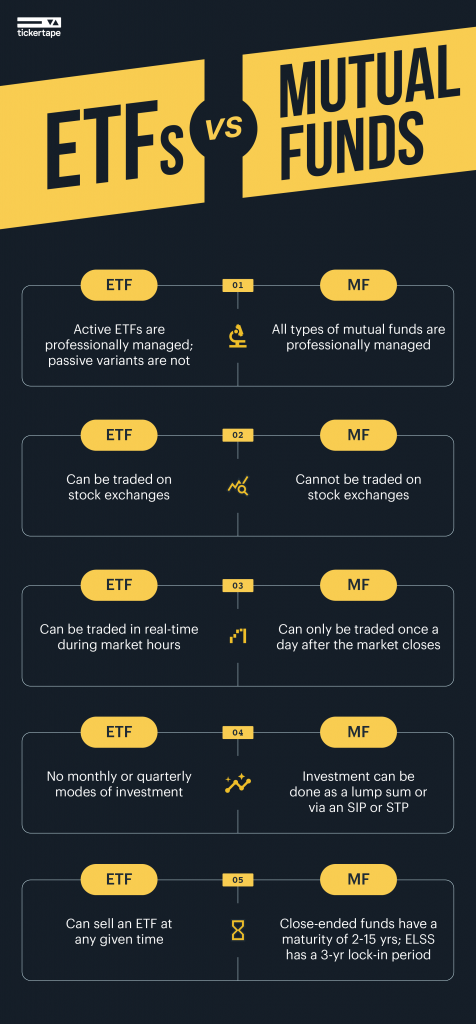

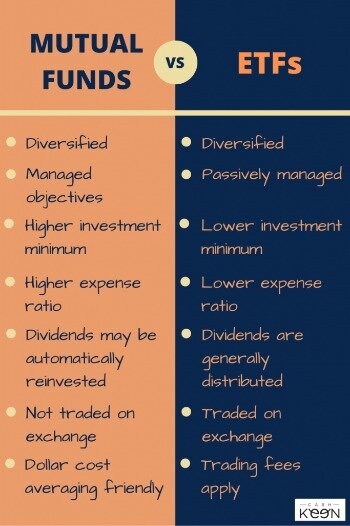

Index Funds vs. ETFs vs. Mutual Funds: Which Is Best?A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. Compare ETF vs. mutual fund minimums, pricing, risk, management, and costs, then weigh the pros and cons. Key Takeaways � Mutual funds are usually actively managed. � ETFs are usually passively managed and track a market index or sector sub-index.