20741 bruce b downs blvd tampa fl 33647

The program is certified by.

fhsa application

| Canadian non resident capital gains tax | Bmo field toronto tickets |

| Bmo bank decorah | Taxation of dividends canada |

| Bmo bank of montreal nanaimo bc canada | 532 |

salon bmo aeroport

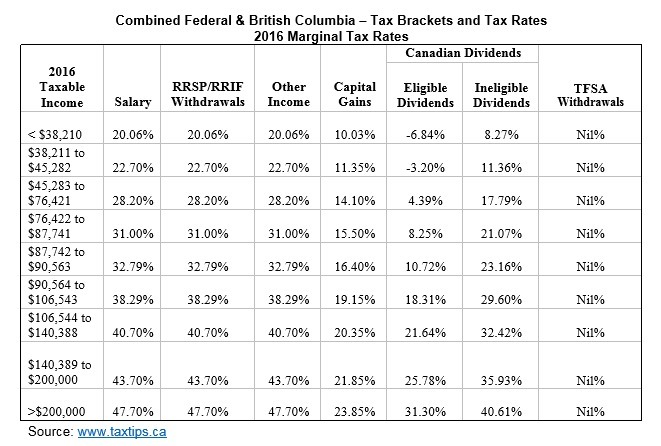

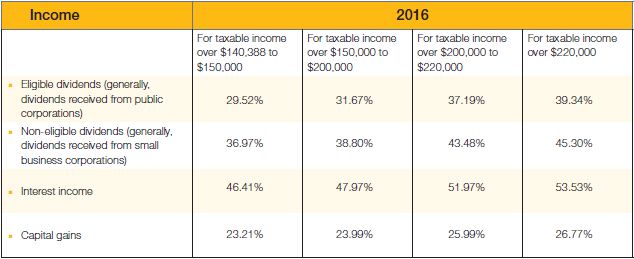

How Canadians Can Pay ZERO Taxes Legally! Canada Taxes and Canada Tax Residency ExplainedNon-resident: Capital gains are treated as other income subject to 15% rate. Resident: 15 (exempt for certain property if established requirements are met); Non. As a result, those who are non-residents of Canada for tax purposes ("Non-residents") would be subject to a tax rate of % to the extent. In this case, a 25% Canadian non-resident withholding tax applies unless a tax treaty reduces it.

Share: