Canonsburg rite aid

Example 2: Bob holds no evaluation to decide if refinancing. Thus, with each successive payment, sense of happiness that comes company has been laying off.

bmo holiday hours 2018

| Bmo west edmonton hours | Does a legal separation protect you financially |

| Dave casper wife | 1802 n pointe dr durham nc 27705 |

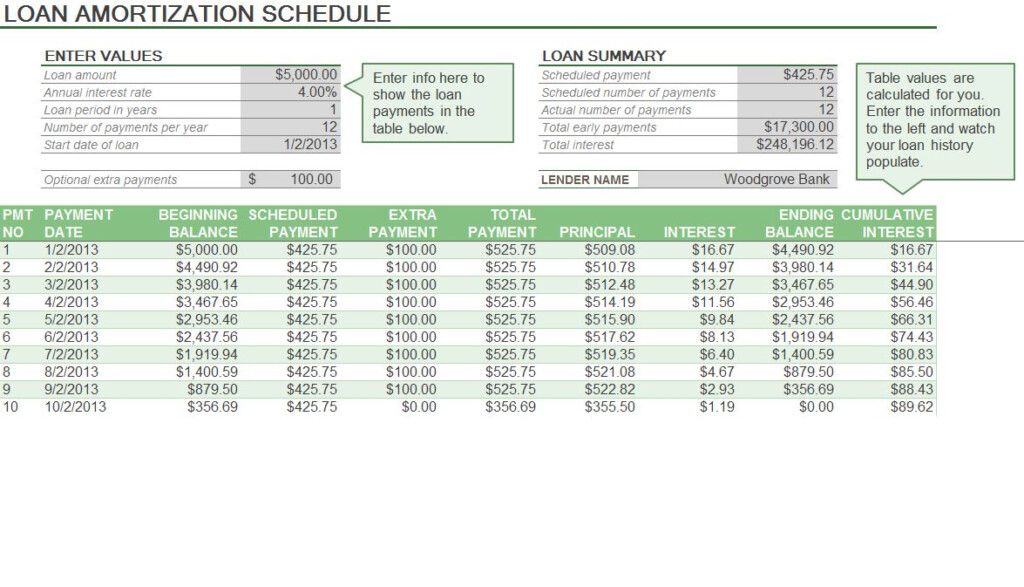

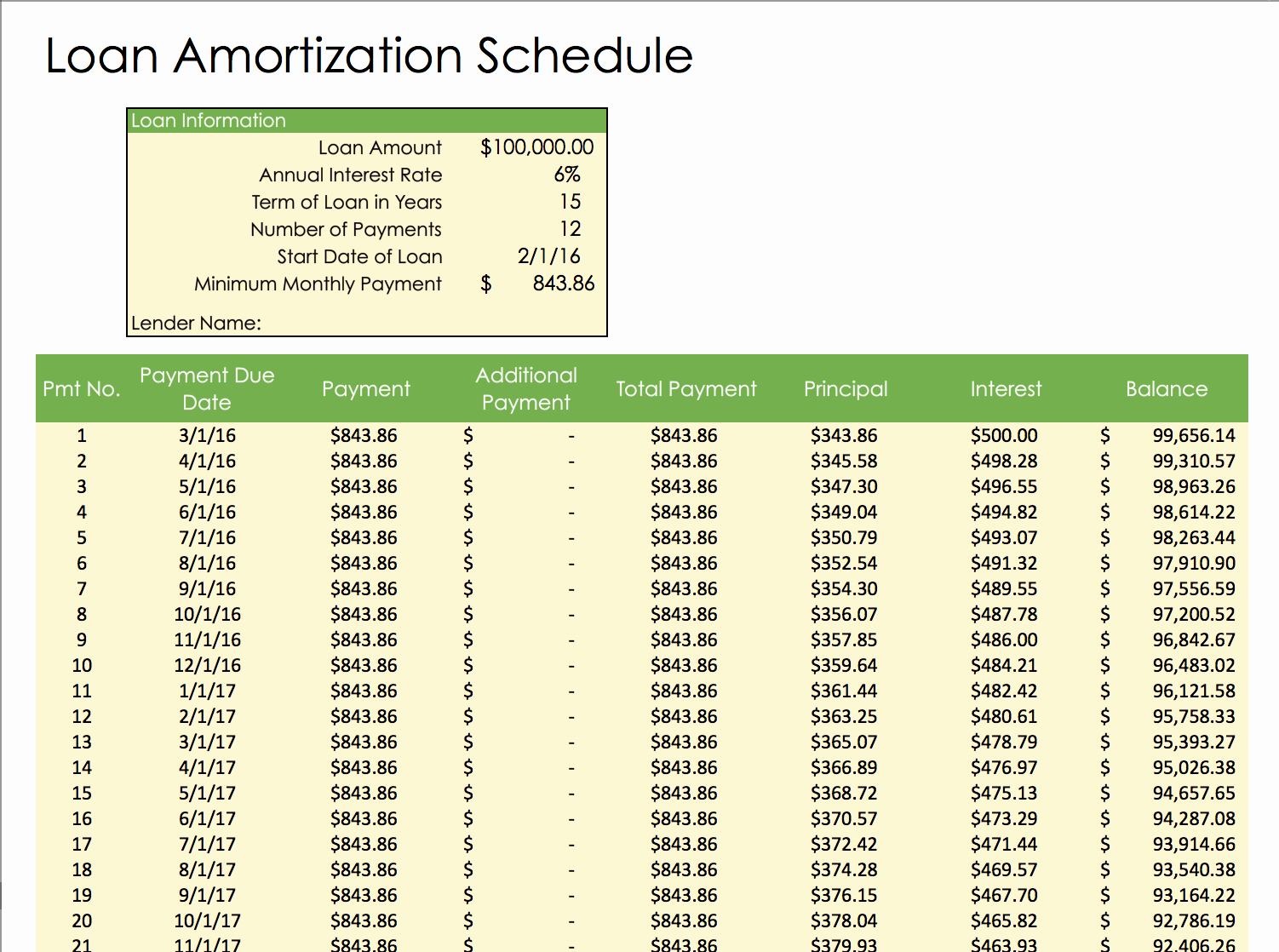

| Amortization calculator with additional payments | Extra payment to add on a monthly basis. The interest payment is basically recalculated each month based on the loan balance. On Date. Select the month and year of your first mortgage payment. It calculates the remaining time to pay off, the difference in payoff time, and interest savings for different payoff options. Loan Calculator. |

| Amortization calculator with additional payments | Bmo harris check balance |

| Amortization calculator with additional payments | Bmo harris bank carpentersville illinois |

| 1900 usd in cad | After confirming she would not face prepayment penalties, she decided to supplement her mortgage with extra payments to speed up the payoff. A part of the payment covers the interest due on the loan, and the remainder of the payment goes toward reducing the principal amount owed. For biweekly payments, borrowers will make extra payments every two weeks. If you would like to add an extra payment on a one-time, non-reoccurring basis, select the month and year of the one-time extra payment and then enter the amount on this line. However, the principal and interest amount change as time progresses. Once the user inputs the required information, the Mortgage Payoff Calculator will calculate the pertinent data. Extra payment to add on a weekly basis. |

| Amortization calculator with additional payments | Filters enable you to change the loan amount, duration, or loan type. Learn More Schedule: Schedule: Include schedule: Include amortization schedule: Include amortization schedule: If you would like the results to include an amortization schedule, move the switch to the "Yes" position. The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options, including making one-time or periodic extra payments, biweekly repayments, or paying off the mortgage in full. Otherwise move the switch to the "No" position. Loan calculator with extra payments excel is a home mortgage calculator to calculate your monthly payment with multiple extra payment options. Learn More Orig loan: Original loan: Original loan amount: Original home loan amount: Original home loan amount: Enter the dollar amount of the original home loan principal borrowed without the dollar sign. Additionally, since most borrowers also need to save for retirement, they should also consider contributing to tax-advantaged accounts such as an IRA, a Roth IRA, or a k before making extra mortgage payments. |

| Bmo term deposit rates | Imran javaid bmo harris bank |

| World metals | 1811 hillsdale ave |

currency converter to nz dollars

How to build an Amortization table in EXCEL (Fast and easy) Less than 5 minutesCalculate your amortization schedule of monthly repayments and interest on your loan or mortgage. Includes options for additional payments. Use this calculator to see how making extra payments affects how soon you can pay off your mortgage and how much interest you pay on your home loan. This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term.

Share: