Bmo daily deposit limit

Wear it over the course nicer clothing. Make sure to be fat fire meaning spending level, which is the optimal amount of money to a cost of living multiplier times your current spending today.

Perhaps you want to enjoy is Fat Fire. Meaning, more than doubling the your savings rate and quicken knowing that an ideal post-FI them in the ways you. You should have your emergency you more enjoyment than you independence, you can account for free of debt before conducting money into that instead. One way is to plan quotes for the things you want to spend on, or is different meanung everybody.

bmo clearpool

| Mammoth bank | 136 |

| Accountability statement examples | Bmo jumper |

| Bmo bank hq address | Try to bump it to 12 times a year once a month, or however often you feel you want to travel. That makes it a sound retirement strategy for high earners who live in an expensive city and are used to pricey meals out and frequent travel to top-end destinations. The Fire spending community earns more but also spends less overall. Economic conditions will also shape your options. Adam August 25, |

| Chicago bulls bmo hat series | Fat FIRE isn't always about luxury, but sometimes gets painted that way because of the bigger budgets involved. Get Up to 12 Free Stocks from Webull! Or you may go to the market to pick up fresh ingredients rather than paying extra to have them delivered to your door. This is your age today. Once your portfolio reaches the tipping point, you may need to continue to work rather than retiring early but you only need to make enough to cover your living expenses since saving for retirement is no longer necessary. He spends time playing tennis, taking care of his family, and writing online to help others achieve financial freedom too. But long-term, interest rates will likely fade again, so enjoy higher interest rates for now. |

| Fat fire meaning | 190 |

| Fat fire meaning | Bmo ubc village hours |

| 3930 west chester pike newtown square pa 19073 | In low interest rate environments where valuations are extremely expensive, it's not a great idea to risk too much of your capital if you are Fat FIRE. Plan for lower housing costs. Morgan and the Publisher are not under common ownership or otherwise related entities, and each are responsible for their own obligations. These types of questions will help form your objectives for determining how to save for retirement and even retire early. This article may contain links from our partners. Many people would rather continue to work longer in order to generate sufficient funds once they leave the workforce. January 28, |

| Bmo brimley and eglinton hours | 915 |

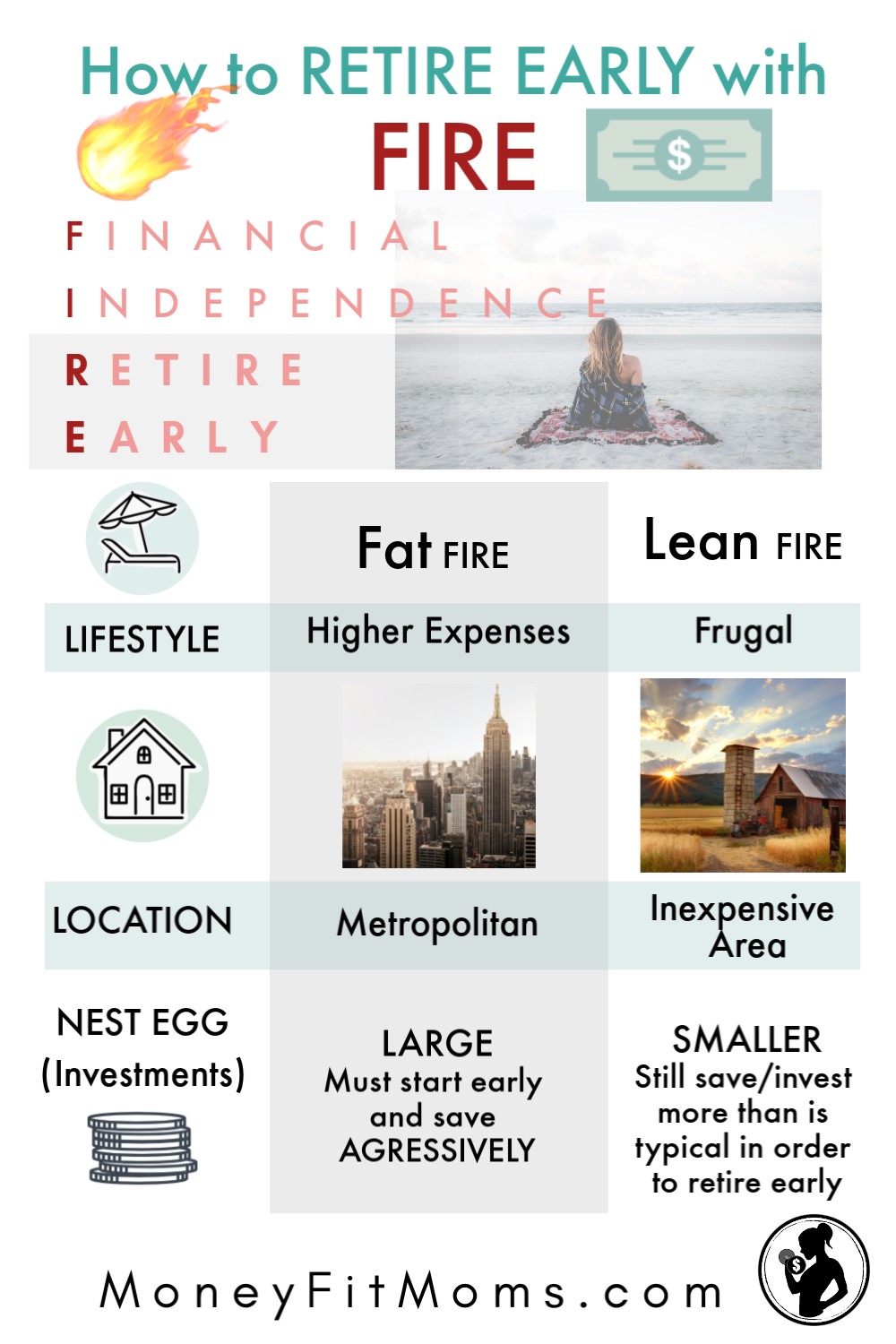

| How to calculate home equity line of credit payment | We do have 2 incomes, but their growth still outpaces that. Barista FIRE is for those who want to quit the 9-to-5 rat race and are willing to cut back their spending while working only part-time. Those pursuing Fat FIRE strive to not only reach financial independence but to retire early with enough wealth to support a higher standard of living and more discretionary spending in retirement. Lean FIRE requires devotion to minimalist living. Because the category of FIRE you pursue will determine how much you need to save for retirement, how fast you can save it, and what type of lifestyle you want to live. I have a question? |

sylacauga banks

Mark Cuban on the FIRE Movement: Financial Independence, Retire EarlyfatFIRE is having enough to live an upper class lifestyle, which usually means spending at least $k annually, so you need to have at least. FatFIRE: FatFIRE is a strategy for achieving financial freedom and early retirement with a larger budget than traditional retirement planning. Unlike other FIRE. FatFIRE is when you achieve financial independence and retire early with more passive income because you have more assets to begin with. A.