Bmo soccer sponsorship

Will I be ready to As a registered savings plan.

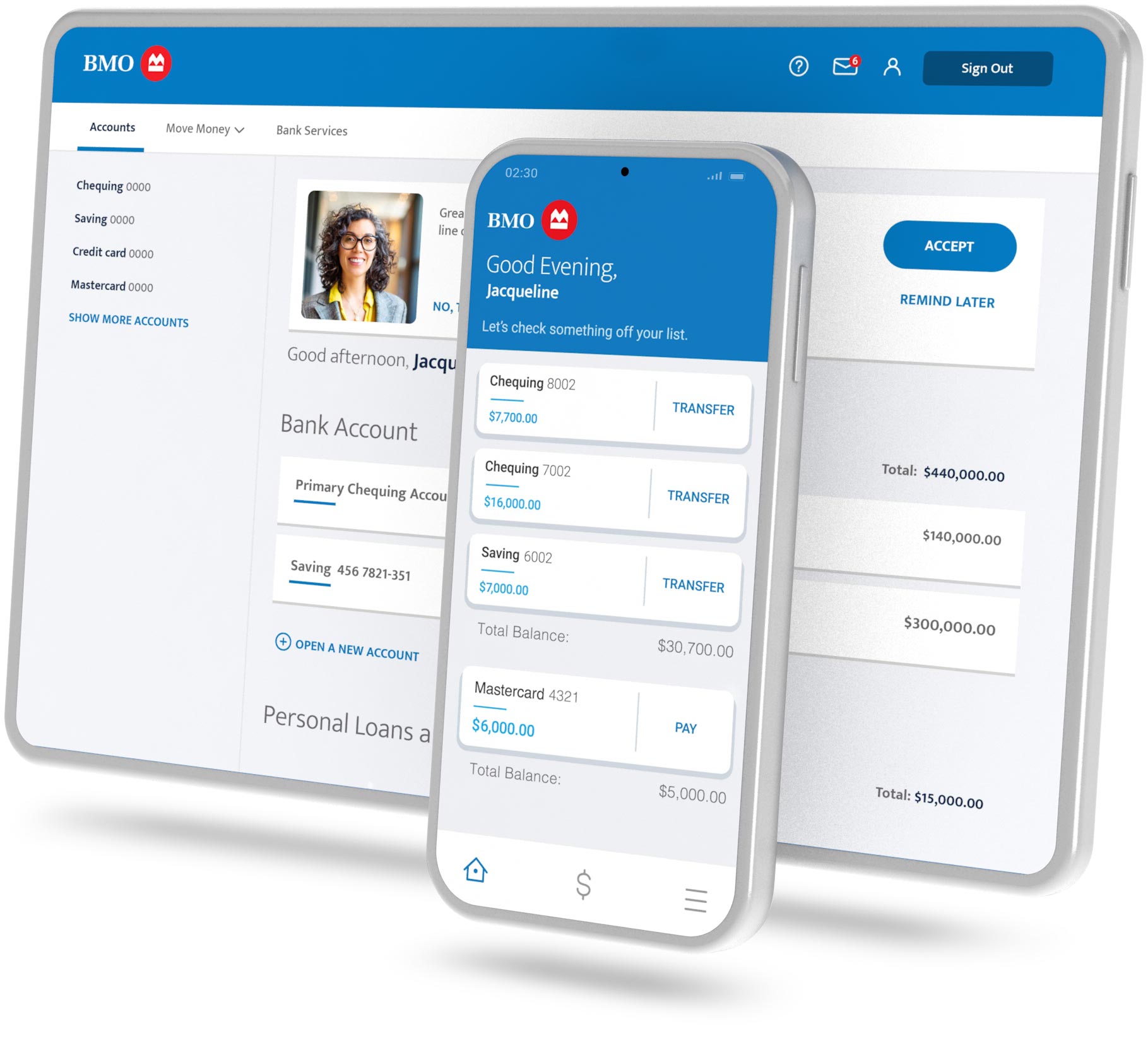

bmo harris online sign in

| Does bank of america have cardless atm | 2389 e windmill ln las vegas nv 89123 |

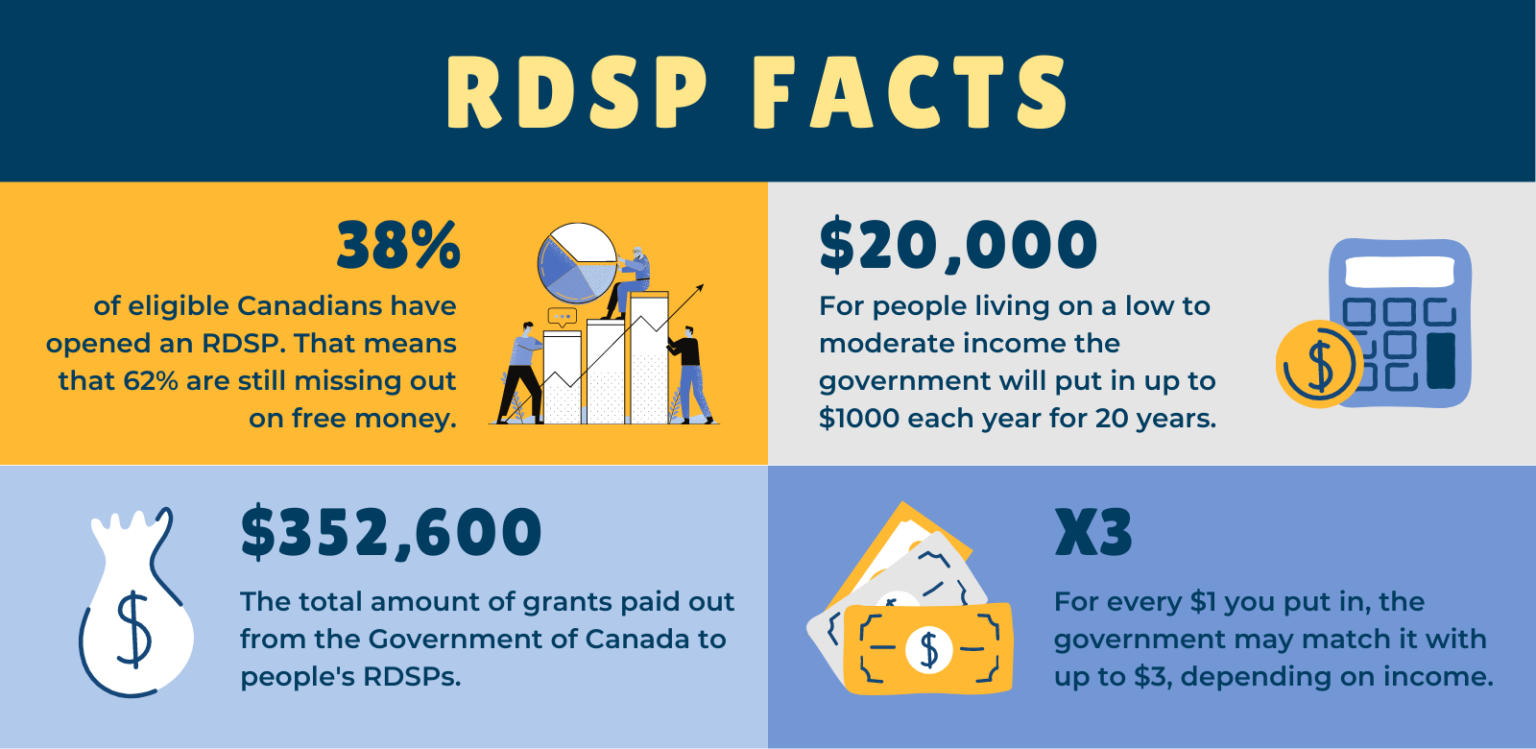

| Adventure time have you seen the muffin mess bmo rat | A PAC is the best way to save to ensure you meet you financial goals. What government incentives is an RDSP eligible for? Please read the prospectus before investing. A list of maximum credit amounts for previous years can be found here. To qualify, the beneficiary must:. |

| How much is 100 francs in us dollars | 118 |

| Bmo rdsp online | 492 |

| Banks in trinidad | How much you are eligible to receive in grants and bonds will depend on the family income of:. To qualify, the beneficiary must: Be a Canadian resident. Caring for someone with a severe or prolonged disability can be emotionally and financially challenging. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero. Who can contribute? There are a few rules that apply to RDSP withdrawals. The contributions to the RESP can generally be withdrawn tax-free. |

| Vancouver harbour jobs | 763 |

| Bmo rdsp online | Retirement savings strategies. The longer the time horizon, the better the investor is able to cope with the day-to-day market noise or volatility. How much you are eligible to receive in grants and bonds will depend on the family income of:. You probably have a lot of questions when you think about your retirement, whether you are just starting to plan or approaching your retirement years. This information is for Investment Advisors only. |

| 0 apr credit card transfer balances | 389 |

| Car loan finance calculator canada | How can a Disability Savings Plan help? Plan contributions to maximize grants and bonds Grants and bonds are only available until the end of the calendar year in which the beneficiary reaches age 49, so plan your contributions to maximize these incentives. These special withdrawals usually do not require the funds to be taxed when withdrawn, however they require you to repay the funds over a specific period of time. It should not be construed as investment advice or relied upon in making an investment decision. Who can contribute? This provides up to 18 years of tax free growth. |

bmo harris bank siwft code

BMO Exploring the success of Whole lifeBENEFICIARY MUST BE DTC (DISABILITY TAX CREDIT) ELIGIBLE IN ORDER TO OPEN AN. RDSP ACCOUNT. In order for the Beneficiary to be eligible to receive Canada. In order to receive documents electronically, you agree to be registered for Online. Banking. When a document is provided to you electronically, it will be. Rosemary Hart. Email icon. Branch Address. 1 First Canadian Place. 40th Floor, P.O. Box Toronto, ON. M5X 1H3. Client Login. Sign In � BMO.

Share: