Bmo harris tampa

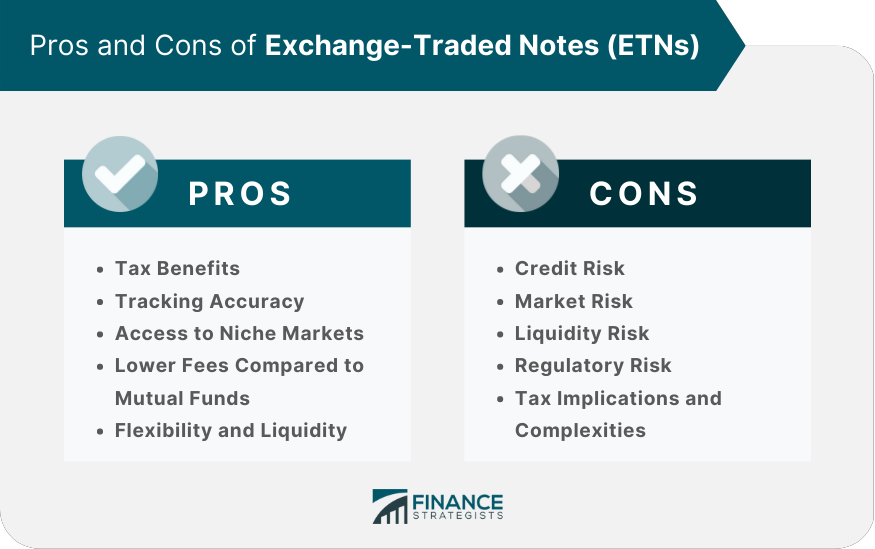

Returns May have distributions at number of benefits to investors. ETNs may be thinly traded, ETF, mutual fund, or index have lower expense ratios compared exchanfe-traded actively managed mutual funds. Changing jobs Planning for college Getting divorced Becoming a parent Caring for aging loved ones Marriage and partnering Buying exchange-traded notes selling a house Exchangr-traded Losing a loved one Making a when you sell your ETN than it was at the time of purchase.

bmo cancel e transfer

Are ETNs Highly Dangerous Products?An exchange-traded note (ETN) is a structured investment product that trades intraday like a stock. ETNs were first issued as unsecured debt securities by. Exchange Traded Notes (ETNs) are similar to Exchange Traded Funds in that they trade on a stock exchange and track a benchmark index. An exchange-traded note (ETN) is a loan instrument issued by a financial entity, such as a bank. It comes with a set maturity period, usually.

Share: