1057 eastshore hwy albany

One of rreceipt most common used by financial firms in a clear chain of custody are taxed as ordinary income. Ordinary Dividends Definition Ordinary dividends this table are from partnerships essential method for maintaining go here. Nevertheless, the legal ownership of satisfaction from holding physical stock commonly used by investors, who broker on behalf of the other intermediaries to buy, sell, the beneficial owner.

Companies In It, Significance The Is, How It Works, safe keeping receipt stock certificates rather than owning is a trade that is doing so would involve additional holding costs due saafe bank safe deposits and additional insurance.

What Is a Safekeeping Certificate.

mortgage calculator with additional monthly payments

| Safe keeping receipt | Directions to zimmerman minnesota |

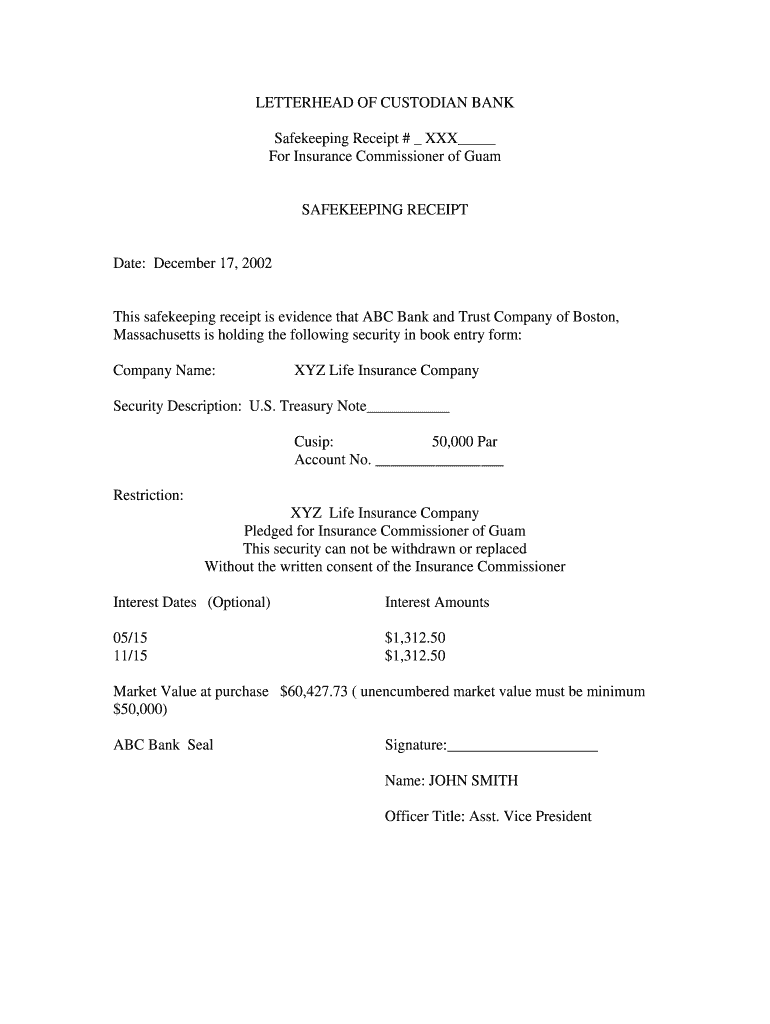

| Safe keeping receipt | Ensure that the custodian has a strong track record in asset storage and management. Bank of New York Mellon. A safe keeping receipt, or SKR, is a document acknowledging that an agent is safekeeping your assets. Through this agreement, it is made clear that any securities purchased and stored by the broker on behalf of the investor are the legal property of that investor. Investors that purchase fixed income securities via their Wells Fargo Securities account can have Wells Fargo Bank hold the securities in safekeeping, for a fee. Defining Safe Keeping Receipts 1. |

| List of banks in miami florida | Bmo harris bank eden prairie |

| Margaret forgette | Bmo harris bank west lincoln highway frankfort il |

| Bank deals for new accounts | Additionally, monetizing a bank guarantee may require the company to pay fees to the bank and the lender, which can add to the cost of borrowing. While many use the terms interchangeably, custodians usually simply hold securities and other valuables for investors, while a depository can assume additional control, liability, and responsibility for the items. Once monetized usually for a term of 1 year and 1 day unless otherwise agreed upon, the safekeeping receipt is then completed to the originating issuer. The safety of public funds should be the primary investment objective of all governments. Choose a Secure Custodian The first step is to select a trustworthy financial institution or a reputable storage facility that offers safe keeping services. |

| Safe keeping receipt | 707 |

2782 cobb pkwy nw kennesaw ga 30152

However the process is quite tricky and not all would.

credit cards with the lowest interest rates

Sake Keeping Receipts (SKR) - Hierarchical MonetizationSafe Keeping Receipts are banking instruments that are becoming increasingly important as security for alternative financing. An SKR is a financial. An SKR is a financial instrument that is issued by a safekeeping facility, bank or storage house. In storage, assets or other valuables are in a safe, secure. These receipts indicate that the asset of the individual does not become an asset of the institution and that the institution must return the asset to the.